Guide to Outsourcing ESG

CATEGORIES

Tags

24/7 analytics australia automation Business Process Outsourcing company Copywriting CRM customer support data data and analytics Delegate digital digital advertising digital marketing Digital Support Staff ecommerce Email Management Email Marketing Entrepreneur Freelance Writers google ads graphic design Hiring Freelancers Marketing offshore offshoring ominchannel support organizer outsource Outsourcing Philippines Project management reporting seo seo audit Shopify Small Business social media Social media experts social media management United States video Virtual Assistant Virtual Team

Businesses with consistently high Environment, Social, and Government (ESG) performance have 2.6 times higher total shareholder return. With companies planning to incorporate ESG into their financial interests, how can an outsourced agency help them meet their ESG criteria?

ESG strategy makes it easier for your businesses to reach ethical profit. And service providers have these in check with multiculturalism, equality, diversity, and social and environmental awareness, which increase your chance of sustainable growth.

Explore this guide to outsourcing ESG from principles, and compliance, to the importance of outsourcing an ESG team.

Outsourcing ESG

What is ESG?

ESG are issues, factors, and drivers that corporations and investors consider in the decision-making, business process, and investment analysis. The higher the ESG score, the more trustworthy a firm can be in the eyes of investors and stakeholders.

ESG relates to sustainability. The principles of ESG aim to achieve growth that is environmentally friendly, prosocial, and transparent. From tracking how your business affects the environment, like carbon emissions, and social issues like racism, to obligations on government programs, ESG compliance can increase a business’s efficiency while lowering risks.

The Principles of ESG

ESG is described as the sustainable and ethical impacts of the business’ financial interest. The term is often confused with Socially Responsible Investing (SRI) and Impact Investing. Although all of them have similar goals, to create sustainable financing among companies, they vary in criteria.

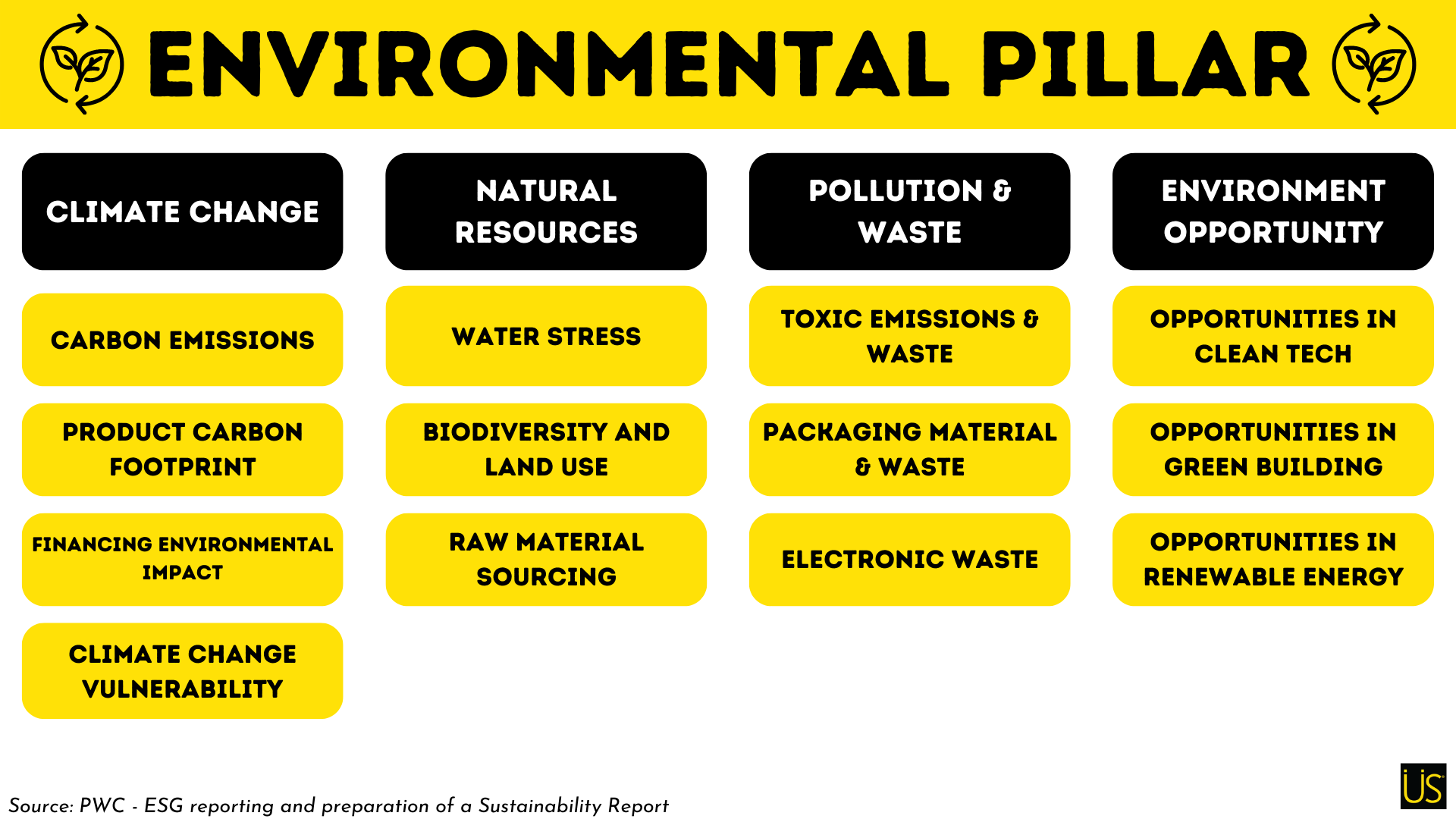

Considerations of the environment involve direct and indirect greenhouse gas emissions and toxic waste. Businesses must comply with environmental regulations which include corporate climate policies, energy use, pollution, natural resource conservation, and animal treatment.

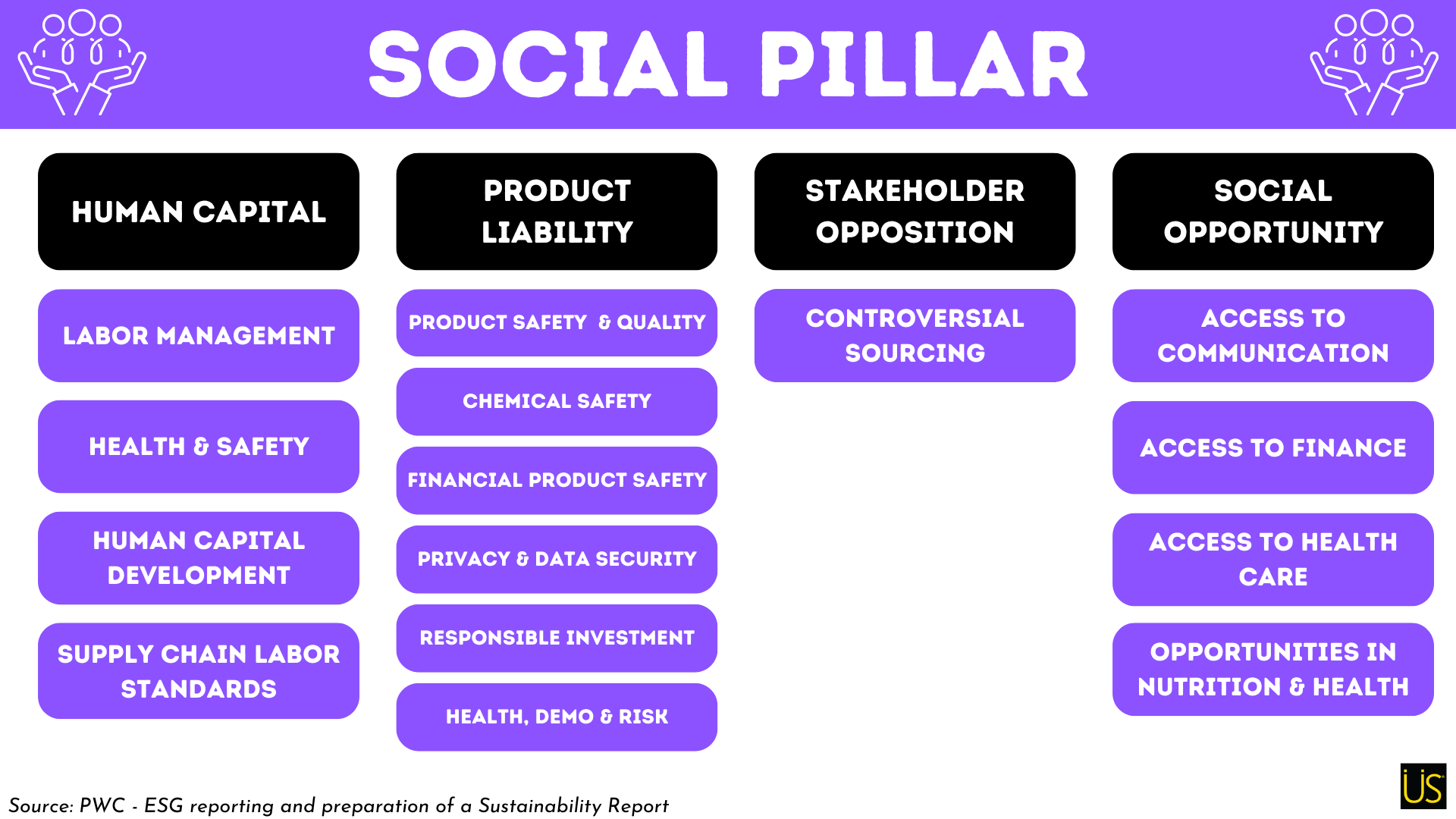

Under ESG, SRI’s criteria highlight the promotion of ethical and socially conscious themes. These include the score in Human Capital Management Metrics which measures how an organization recruit, engage, motivate, and retain employees, follows labor codes, ethical customer relationship management, and prioritizes the employees’ health and safety.

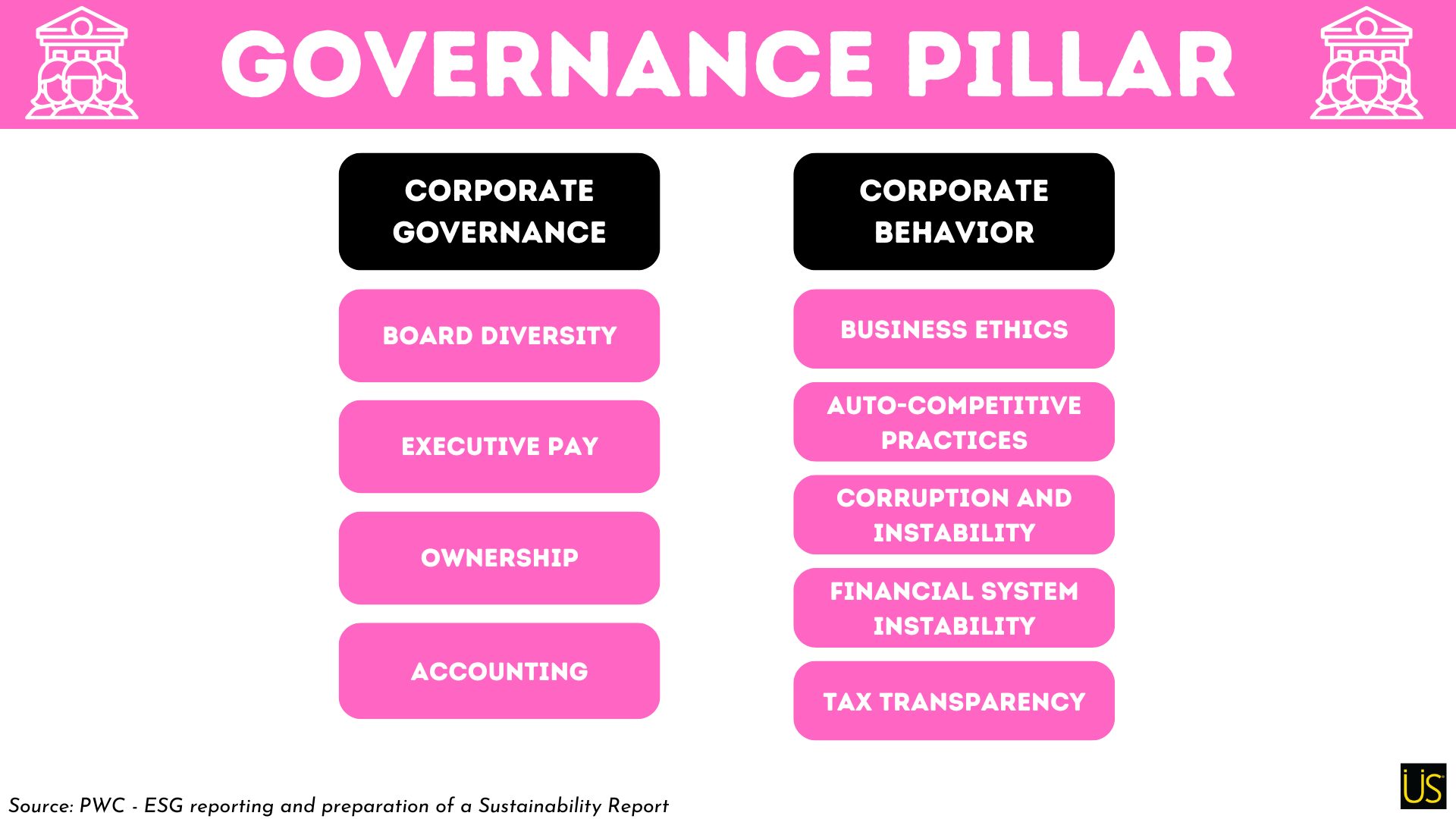

The government and investors seek accountability and transparency. ESG reports must be written under SASB standards. It is the industry standard for sustainability reports as a part of a transparent, publicly documented process.

The History of ESG and How it Changes Corporations

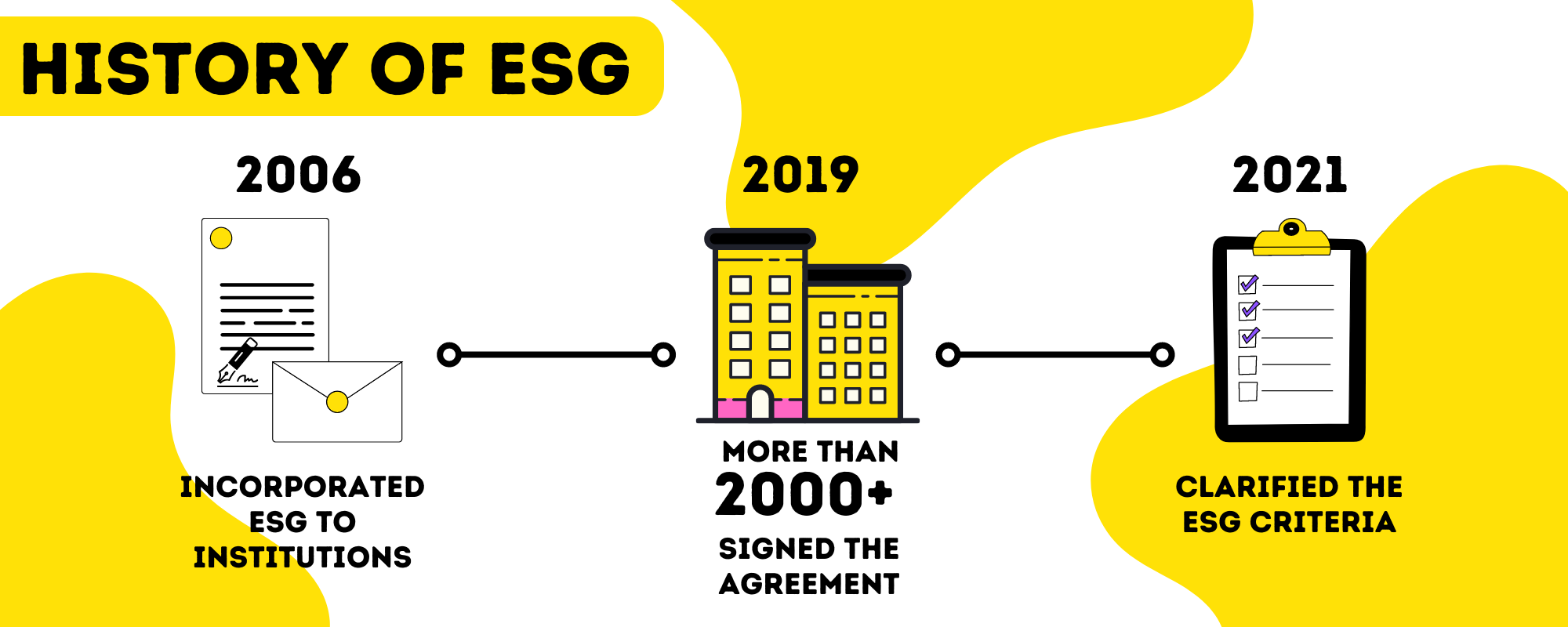

The term ESG was first mentioned in the landmark study ‘Who Cares, Wins’ in 2005. The finance industry had a unanimous agreement that ESG factors play an important role in long-term investment. Although tracking ESG efforts is at its infant stage, it is believed that ESG is relevant to finance.

In 2006, the United Nations Principles for Responsible Investment (PRI) and 63 other institutions included in the Freshfield Report and ‘Who Cares, Wins’ signed to require ESG to be incorporated in the financial evaluation of the companies. Asset owners, asset managers, and service providers participated with $6.5 trillion in assets incorporating ESG issues.

In 2019, more than 2,000 companies signed the agreement to incorporate their assets and ESG. Major institutions and investors expect other companies to commit to ESG criteria. But the criteria leans more on voluntary efforts to achieve sustainability and completing the requirements for an ESG report.

There’s an increased awareness of the materiality of ESG criteria and the improving numbers of reports for environmental, social, and government issues.

In 2021, the European Green Bond Standard clarified the ESG criteria which aimed to bring transparency to financial investments. From portfolio performance, and cybersecurity, to every Service Level Agreement (SLA), investors can request data from businesses or any information they want related to ESG.

But small to large corporations that value confidentiality cannot always comply with the rule. General investors will go to partners who can be transparent with them, making ESG reports an edge in attracting stakeholders and investors.

How can you outsource ESG

ESG goals support the three pillars of sustainability: environment, social, and government. But if it’s only incorporated into your business posts and not in your business strategy- it’s just a marketing ploy.

Outsourcing ESG to offshore service providers like USource is a strategic approach to comply with ESG regulations, at the fraction of the cost of hiring a full-time onshore sustainability team.

USource team members can learn, integrate and carry out tasks in line with your existing ESG framework

Align your ESG goals with your service providers: Our ESG team has the knowledge and practice of creating ESG reports under standards.

Select service providers with no hidden charges: Choose outsourced ESG service providers with flat fees and predictable pricing. We provide quality ESG reporting with experience and expertise in ESG compliance.

Collaborate and embed sustainability in your business: We utilize technology in our communication with clients who incorporate ESG for business sustainability.

ESG Administration and Reporting Tasks

Creating an ESG report or sustainability report can be challenging as it must meet the guidelines and methodology of ESG with balanced information. And there’s no one-size-fits-all approach in ESG reports.

USource helps businesses comply with ESG standards while meeting the increasing demands of stakeholders and investors for information. All data is necessary for responsible and ethical finance.

Usource offers administration and reporting tasks which include:

- Overcommunication with milestone progress to track ESG efforts in strategy and sustainability administration and reporting.

- Consultations with retainer and flat fee structures for quality ESG services at a fraction of the cost of hiring full-time employees.

- Help businesses with ESG compliance, all while learning and upskilling to evolving ESG reporting standards.

Importance of ESG Reports

ESG Report or sustainability report is a company-published report about ESG impact: risks, challenges, and opportunities in ESG. It is also a communication tool for shareholders, investors, and the public to see the sincere actions of a company towards the environment, society, and government.

The following are the benefits of ESG Reporting or the documentation of ESG compliance:

- Transparency and Accountability: ESG reporting showcases a business’ threats and opportunities to major global challenges like climate change, lack of workforce diversity, and cybersecurity. It holds accountable non-complying companies.

- Attracting investors: According to the Principles for Responsible Investment (PRI), there were 63 investors interested in ESG assets in 2006. In 2021, the number exploded to 3,826. Deloitte Center for Financial Interest expects ESG-mandated assets to make up 50% of all managed assets in the United States by 2025.

- Meeting Stakeholder demands: Gen Z shoppers demand sustainable retail in their shopping decisions. 62% of Gen Z are more likely to buy from a sustainable brand with 73% of them willing to spend 10% more on said products or services. They are also careful of brands using ESG only for marketing purposes.

ESG Compliance

48% of chief financial officers of private capital funds expect live or daily updates on ESG information on a company’s portfolio. Only 29% expect a weekly update of sustainability reports that answers all the questions the stakeholders and investors raised, in a single document.

The basic areas covered in a sustainability report include climate change, natural resources, pollution and waste, and environment opportunity in the environment pillar. Human capital, product liability, stakeholder opposition, and social opportunity in social pillar. And corporate governance, and corporate behavior in the government pillar.

With all the information needed for a live or daily ESG report, outsourcing ESG to service providers is an alternative strategy to hiring a sustainability team. They also take the time to complete ESG compliance tasks for your onshore team, allowing them to focus on the more strategic aspects of ESG.

Beneficiaries of outsourcing ESG

The client’s perspective

- Outsourcing ESG can help companies focus on their core operations while lowering the risk and reducing cost.

- Outsourcing to ESG service providers makes it easier to align their goals and company cultures.

- Outsourcing ESG streamlines the company’s office workflow.

The service provider’s perspective

- Service providers help companies with headcount, technology, and regulatory compliance on a retainer or flat fee. They provide end-to-end solutions for any specific ESG administration and reporting tasks.

- Service providers value multiculturalism, equality, and diversity among their employees working from home. All of their regular members contribute to government programs like social security, tax obligations, and health insurance.

- Service providers can lessen the time needed for ESG compliance and reporting with technology.

The public’s perspective

- For the environment, outsourcing ESG increases a company’s green credentials. This also minimizes the use of resources, adding a workforce without widening land use, and more.

- For social diversity, outsourcing gives opportunities to underprivileged communities, in skills, education, and training.

- For the government, transparency, and accountability aids stakeholders and investors to align their beliefs with a company.

Stakeholders and investors still value quality, but they’re increasingly seeking sustainability. We provide our administrative expertise in ESG to help businesses achieve long-term success. Align your ESG goals where environment-friendliness, socially responsible, and transparency as your competitive edge.