Philippines BPO Employment Statistics (2022)

CATEGORIES

Tags

24/7 analytics australia automation Business Process Outsourcing company Copywriting CRM customer support data data and analytics Delegate digital digital advertising digital marketing Digital Support Staff ecommerce Email Management Email Marketing Entrepreneur Freelance Writers google ads graphic design Hiring Freelancers Marketing offshore offshoring ominchannel support organizer outsource Outsourcing Philippines Project management reporting seo seo audit Shopify Small Business social media Social media experts social media management United States video Virtual Assistant Virtual Team

The resilient economic driver of the Philippines with over 11% contribution to national GDP, the Business Process Outsourcing (BPO) industry is predicted to see increasing national revenue and operations only improve after recent challenges.

More than 1.2 million Filipinos work in over 800 BPO companies in the Philippines. The country started by supporting international businesses with customer service and then eventually offering hundreds of digital services.

BPO has a long history in the Philippines, and the country is fast outpacing India as the BPO capital of the world.

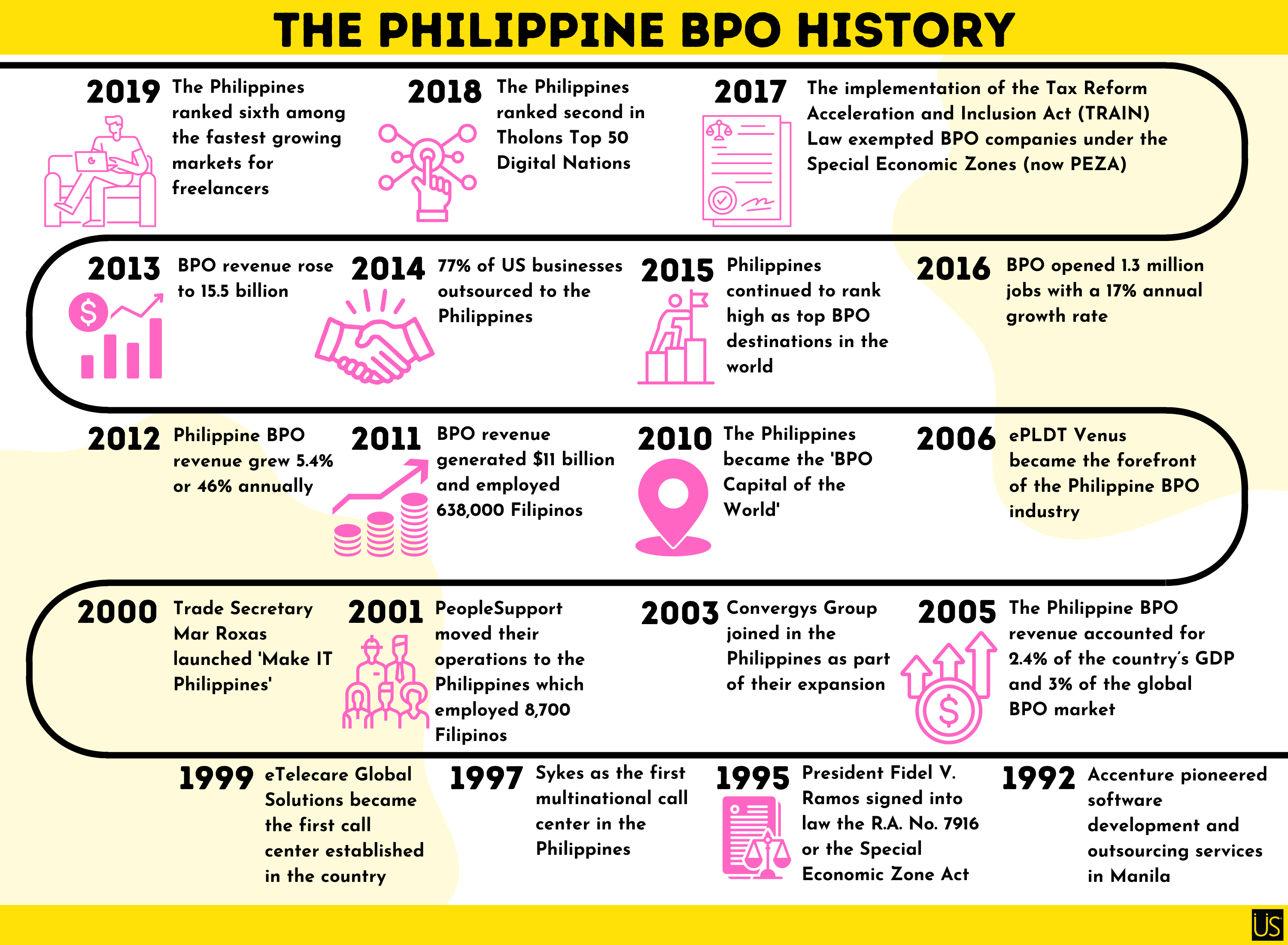

The Philippine BPO History

- 1992: Accenture’s Global Resource Center in Manila pioneered software development and outsourcing services in Manila.

- 1995: The Philippine Congress under President Fidel V. Ramos signed into law the R.A. No. 7916 or the Special Economic Zone Act. Tax breaks promote the Philippines as an ecozone for local and foreign investors.

- 1997: Sykes became the first multinational call center to operate in the Philippines.

- 1999: eTelecare Global Solutions became the first call center established in the country.

- 2000: The national BPO contributed 0.075% in national revenue. Under Trade Secretary Mar Roxas launched ‘Make IT Philippines’ to organize IT-enabled services attracting BPO investors in the Philippines.

- 2001: PeopleSupport moved their operations to the Philippines which employed 8,700 Filipinos.

- 2003: Convergys Group chose the Philippines along with India as part of their expansion and revenue generation plan.

- 2005: The Philippine BPO revenue accounted for 2.4% of the country’s GDP and 3% of the global BPO market.

- 2006: ePLDT Venus became the forefront of the Philippine BPO industry, accounting for 5.4% of the local economy.

- 2010: The Philippines became the ‘BPO Capital of the World.’ With 525,000 Filipinos employed in call centers attracting foreign investors.

- 2011: BPO revenue generated $11 billion and employed 638,000 Filipinos.

- 2012: Philippine BPO revenue grew 5.4% or 46% annually since 2006.

- 2013: BPO revenue rose to $15.5 billion with 900,000 Filipinos working full-time.

- 2014: 77% of US businesses outsourced to the Philippines with $18.2 billion in revenue.

- 2015: The Philippines continued to rank high as one of the top BPO destinations in the world.

- 2016: BPO opened 1.3 million jobs with a 17% annual growth rate. Only 14.7% of the IT-BPM workforce are in high-skilled roles.

- 2017: The implementation of the Tax Reform Acceleration and Inclusion Act (TRAIN) Law exempted BPO companies under the Special Economic Zones (now PEZA).

- 2018: The Philippines ranked second in Tholons Top 50 Digital Nations with Manila as the second placer in the Top 100 Super Cities.

- 2019: The Philippines ranked sixth among the fastest-growing markets for freelancers. Companies focused on employee upskilling more than in the past year

2020: The height of the pandemic

Even before the lockdown, working from home was a popular work arrangement. 40% of BPO employees work in the comfort of their homes either as a part of the gig economy or in BPO companies with remote work options/without local offices.

In the days of the pandemic, the BPO industry remained resilient. The oil and tourism industry plummeted during travel restrictions. The outsourcing industry’s revenue, by contrast, soared and is now second only to overseas remittances which still make up a large part of the country’s revenue from its enduring group of OFWs.

BPO employee headcount growth rate rose at 5.8% higher than in 2018.

The BPO industry experienced drawbacks as well. Employees caught Covid-19 and some lost income during self-isolation past their paid sick leave allocations. During the surge, some BPO companies juggled employees on sick leave, business operations, and trying to pivot, with decreased profit margins at the same time. Thus flexible work arrangements entered the scene.

Effects of Covid-19 on the BPO industry

- Community quarantines boosted eCommerce, social commerce, financial services, and logistics.

- 22% of BPO companies continued to work on-site. The Philippine government ordered large BPO firms with more than 100 million pesos assets under PEZA to provide shuttles, meals, and accommodation to employees who work on site.

- 36% of IBPAP members did not expect growth during the pandemic while 3-7% were still expecting it.

- 18% of companies planned to retrench their employees to cut costs amidst the pandemic.

2021: The resiliency of the BPO industry

The government helped corporations to recover from the pandemic with the Corporate Recovery and Tax Incentives for Enterprises Act. The CREATE Act reduces the income tax rate of large companies to 25%. This aimed to help businesses that suffered from the pandemic and to attract investors by cutting corporate income tax.

But tax perks are tied to BPO companies which have 70% on-site employees and only 30% of their workforce working from home. This was until April when the government wanted 100% of these companies’ employees to work on-site.

Despite this and other challenges of the pandemic, the Philippine outsourcing revenue grew 9%, 4% higher than the previously projected 5% in September. The country’s BPO receipts exceeded expectations as other countries outsourced the skills they need.

Healthcare, Animation, and Game Development headcount growth rates had a steady increase from 2019. The Filipinos also looked for higher-value jobs that offered programs for talent upskilling.

As Filipino freelancers upskilled, the Philippine outsourcing industry offered more digital talent and solutions, with skill levels and experience comparable to and even exceeding that of their offshore counterparts.

The resiliency of BPO contributed greatly to nation-building. This includes preserving employment, promoting investments, and promoting rural development. With other industries collapsing during face-to-face restrictions, BPO became a major economic driver.

The Philippine BPO Employment Statistics 2022

2022 had its continuing global upheavals. But BPO workers soldiered on, especially Filipinos who can always be counted on for optimism. According to Singapore-based consumer research firm Mileu Insight and mental health platform Intellect, the Philippines has the best mental health compared to Indonesia and Singapore.

78% of Filipinos rated their mental health as ‘good’, ‘very good’, or ‘excellent’. Their main motivations for doing their best include increased wages, giving their loved ones a good life, and achieving a sense of accomplishment.

It was also in the first half of 2022 that the deadline for the return-to-office of the BPO industry’s WFH employees passed, was extended, and then was permanently done away with. The transfer of IT-BPM companies from PEZA to BOI meant continued tax incentives even with 70-30 WFH work arrangements.

Human Resources

By the end of 2022, industry leaders expect 1.8 million Filipino BPO employees. In addition, to call center employees, the Philippines expands its outsourcing workforce to non-voice and technical specialization in digital like social media managers, web developers, data analysts, and more.

27% of the BPO sector’s workforce disperse across the countryside. Emerging and established hubs expect to erect their offices in provincial areas.

BPO agents in the Philippines average age interval is 18 to 34. In the contact center industry, women outnumber men with 58% female and 42% male at the start of 2022. Men dominate higher-paying jobs like computer programming, software development, and software publishing.

The BDO industry overtaking growth goals

According to IBPAP, the BPO industry surpassed the revenue and employment goals of 1.43 million FTEs and $29.1 billion in revenue with 1.44 million FTEs and $29.9 billion in revenue.

It was a 10.6% jump from last year. With digital adoption and expansion across horizontal and vertical markets became the key drivers for BPO growth.

It is not surprising with the pent-up demand from global customers that the Philippines offer quality at lower costs. Other reasons include higher confidence in flexible work arrangements and the growth in emerging sub-segments of outsourcing. From eCommerce, financial technology, technology, and healthcare.

Turnover and Retention Rate

The turnover rate in the Philippines is higher than in other countries with an estimated 30 to 40%. Attrition is one of the main issues in the BPO industry where employers struggle to find and keep long-term employees.

- 14% of BPO employees plan to shift in the next three to six months.

- If returning to the office is compulsory, one-fifth of 1,400 BPO employees will consider quitting. They are comfortable at home and free to multitask. They also won’t lose time on commutes – which can take one to two hours of their time sitting in traffic.

- Part-time agent’s average stay in a company is 6 months, while the full-time employee’s average is 18 months.

Aside from preferring off-site working arrangements, the common causes of the increasing attrition rate in the Philippines include lack of upskilling, poor working conditions from commuting to clocking out of work, lack of recognition, and excessive workloads.

Forecast Growth Rate of Philippine BPO Employment

IBPAP released the IT-BPM Industry Roadmap 2028. Here are their industry forecasts for the next six years:

- Industry experts expect BPO revenue to double by 2028. IBPAP targets an annual compound growth rate of 10.4% with $58 billion in revenue. They also expect the Philippines to soon become the experience capital of the world.

- A change in opportunity landscapes with the rising demand for IT-BPM services. They’re looking out for the adoption of hybrid work arrangements, favorable government policies, infrastructure development, and a higher supply of skilled talent.

- The IT-BPM industry will open 1.1 million positions with 2.5 million FTEs. The industry can also generate 3 million indirect jobs for allied sectors like retail, hospitality, real estate, infrastructure, and transportation.

IBPAP recommends the following for improving or surpassing the IT-BPM predictions:

- Policy and regulatory support: Enhance a business-friendly environment through unambiguous and relevant policies, aligned with global and local macro trends.

- Talent development: Ensure a sustainable supply of skilled talent through revisions of the existing curriculum and the introduction of new and relevant educational courses.

- Infrastructure: Expand fiber optic networks with 5g capabilities. Ease the process of setting up towers and other related infrastructure. Accommodate hybrid work needs through high-quality commercial real estate with ‘creative hubs’ for a niche industry.

- Investments: To attract and drive more investors, rebrand the Philippines as a provider of high-value experience services.

The BPO industry contributes to the national revenue not only by its direct revenue but also as a significant multiplier effect in retail, logistics, transportation, food, and others.

AI and automation can affect the BPO processes in the future. But a few things will remain the same- outsourcing to the Philippines will still have the same advantage it has today.